House prices have only slightly outperformed inflation over the long term

Most likely that a house is a vital aspect for creating financial stability. Oh no, I didn't mean to say that buying a house is a good investment. In no way. Rather, a house is a cost, your biggest obligation. If you make a poor choice

Home Prospects

Buying a house could take all of your money and leave you with nothing to save or invest. The only way to get rich is to live below your means. If you really want to cut costs, you might want to look into house hacking. So, a few more thoughts, the majority of which I've already discussed.

Try not to sit tight for a real estate market decline. The stockpile of homes might be well under the interest for a long time. At least on a national scale, I don't think we'll see a repeat of the housing sell-off of 2008. You can buy now and, in the event that interest rates fall, refinance in a few years. With lower interest rates, however, house prices may also rise as homes become more affordable.

Therefore, there is no guarantee that waiting for lower mortgage rates or house prices will be beneficial. It might still make sense in the long run if you can locate an excellent long-term residence today.

Renting is now more appealing. Renting is now significantly less expensive than buying in most of the country. Renting gives you the freedom to move and has fixed costs and few unexpected repair costs. In the United States, there is too much pressure to own a home. Renting is preferred by many people, particularly if you intend to stay there for less than five to ten years.

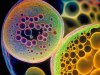

An investment is not your home. House prices have only slightly outperformed inflation over the long term. Additionally, the fact that expenses are not taken into account makes that statistic extremely misleading. Don't buy a home with the expectation of significant appreciation. Buy it for your family and as a place to live.

Tax advantages Apologies, a great many people are not getting a tax reduction from their homes any longer. But then, I actually see real estate agents discussing tax reductions. For married couples, the standard deduction in 2024 will be $14,600, or $29,200. Only a small percentage of people will actually be able to take an itemized deduction for mortgage interest and property taxes. Additionally, there are deduction caps: Up to $10,000 in state and local taxes and $750,000 in mortgage interest only Before 2017, the majority of my customers itemized, but almost none of them do so now.

Financial planning

Financial planning encompasses more than just prudent investing, which is why we discuss topics like home mortgage strategies. The 7.5% mortgage rate is making it harder to buy a house. If you have to buy a house, be aware of the amortization schedule and try to refinance if you can save at least one percent. Back in 2020, I saw individuals who were taking a gander at taking care of a 3% home loan since cash yields were so low. The opportunity cost of paying off a mortgage was something we talked about, and it still applies today. Sadly, in the year 2023, the expected 10-year return of stocks has not changed as much as mortgage rates have, so today's leverage burden of 7.5 percent is too great to ignore.

Take into careful consideration the home mortgage strategies we discussed if you are considering moving. It might make sense to stay put. Prepayments may be an option if you have a high-priced mortgage early on. Choose a mortgage with a 15-year term if you can afford it. I stress significantly over lodging since it has become quite a lot more costly that individuals risk being House Rich and Money Poor. And afterward, nothing remains to be contributed. A home is frequently the largest purchase you will ever make, so choose wisely! Consider how this will increase your net worth in the future.